| 作者 |

標題 標題  |

|

oneeast00

路人甲乙丙

3769 Posts |

Posted - 05/03/2023 : 14:56:40 Posted - 05/03/2023 : 14:56:40

|

quote:

Originally posted by MCSEG

有點意思的東西,烏方秀出一張圖片

https://twitter.com/Osinttechnical/status/1652875263309406209

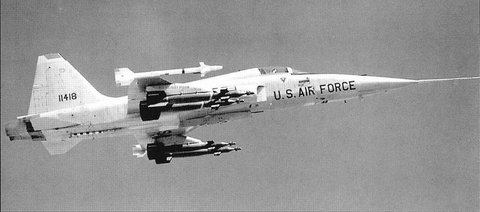

美製五英吋(127) Zuni火箭和Su-25攻擊機,應該是今

美規火箭不算屁

但.....Zuni就是珍獸 ..倒不是多猛,而是賣博物館更值錢...

美軍雖然還在用空射火箭,

但美軍現在統一使用 HYDRA 70mm/2.75吋規格 火箭(就是國軍直升機丟的)

5吋火箭 Zuni其實是越戰時期 F4,F5的彈藥,

當然A-10,F-16也能丟,但是已經20+年沒在USAF上鏡

連訓練掛載都沒上鏡了

據說美軍庫存的Zuni只剩幾千發

|

Edited by - oneeast00 on 05/03/2023 15:03:34 |

|

|

|

hallo84

新手上路

55 Posts |

Posted - 05/03/2023 : 15:30:08 Posted - 05/03/2023 : 15:30:08

|

quote:

Originally posted by waffe

quote:

Originally posted by Atf23

开战(经济金融战所谓weaponizing trade/ finance)1年半,美国20大银行已经倒闭3家了,衰退就在眼前?

20大銀行?前面最大的20家嗎?

我跟你說在我們社區我的老二是前二十大的。我們社區有三百個男的,其中有275個是小學生,成年人25個。而最大的前五個都是黑人,所以你認為我老二有多大?

美國夠份量的銀行一定是投資銀行,也就是投行。而矽谷是商業銀行知道中間的差距嗎?你貸款買房子去投行試試看有幾家會鳥你,但你要是正在研發從海水中煉金而且已經出了可行且有利潤的模式,那你放心投行會把你當爹、當爺、當領導、當大款、當祖宗的給你錢。

大把、大把的給。

摩根大通一家的資產就超過矽谷的20倍以上,你以為矽谷有多大?矽谷銀行大約就是一種遠比你們村鎮銀行大,跟在省城裡可以貸款周轉與買房子的大銀行差不多。

剩下的也差不多了

https://finance.yahoo.com/news/half-america-banks-already-insolvent-133000968.html

Half of America’s banks are potentially insolvent – this is how a credit crunch begins

Ambrose Evans-Pritchard

Tue, May 2, 2023 at 9:30 PM GMT+8

The twin crashes in US commercial real estate and the US bond market have collided with $9 trillion uninsured deposits in the American banking system. Such deposits can vanish in an afternoon in the cyber age.

The second and third biggest bank failures in US history have followed in quick succession. The US Treasury and Federal Reserve would like us to believe that they are “idiosyncratic”. That is a dangerous evasion.

Almost half of America’s 4,800 banks are already burning through their capital buffers. They may not have to mark all losses to market under US accounting rules but that does not make them solvent. Somebody will take those losses.

“It’s spooky. Thousands of banks are underwater,” said Professor Amit Seru, a banking expert at Stanford University. “Let’s not pretend that this is just about Silicon Valley Bank and First Republic. A lot of the US banking system is potentially insolvent.”

The full shock of monetary tightening by the Fed has yet to hit. A great edifice of debt faces a refinancing cliff-edge over the next six quarters. Only then will we learn whether the US financial system can safely deflate the excess leverage induced by extreme monetary stimulus during the pandemic.

A Hoover Institution report by Prof Seru and a group of banking experts calculates that more than 2,315 US banks are currently sitting on assets worth less than their liabilities. The market value of their loan portfolios is $2 trillion lower than the stated book value.

These lenders include big beasts. One of the 10 most vulnerable banks is a globally systemic entity with assets of over $1 trillion. Three others are large banks. “It is not just a problem for banks under $250bn that didn’t have to pass stress tests,” he said.

The US Treasury and the Federal Deposit Insurance Corporation (FDIC) thought they had stemmed the crisis by bailing out uninsured depositors of Silicon Valley Bank and Signature Bank with a “systemic risk exemption” after these lenders collapsed in March.

The White House baulked at a blanket guarantee for all deposits because that would look like social welfare for the rich. Besides, the FDIC has only $127bn of assets (and less very soon) and may ultimately require its own bailout.

The authorities preferred to leave the matter vague, hoping that depositors would discern an implicit guarantee. The gamble failed. Depositors fled First Republic Bank at a fast and furious pace last week despite an earlier infusion of $30bn from a group of big banks.

White knights probing a possible takeover of First Republic recoiled once they examined the books and discovered the scale of real estate damage. The FDIC had to seize the bank, wiping out both shareholders and bondholders. It took a $13bn subsidy along with $50bn of loans to entice JP Morgan to pick up the pieces.

“No buyer would take First Republic without a public subsidy,” said Krishna Guha from Evercore ISI. He warns that hundreds of small and mid-sized banks will batten down the hatches and curb lending to avoid the same fate. This is how a credit crunch begins.

The share price of PacWest, the next on the sick list, fell 11pc in late trading on Monday. That will be the bellwether of what happens next.

The US authorities can contain the immediate liquidity crisis by guaranteeing all deposits temporarily. But that does not address the greater solvency crisis.

The Treasury and the FDIC are still in the denial phase. They blame the failures on reckless lending, bad management, and over-reliance on foot-loose uninsured depositors by a handful of banks. This has a familiar ring. “They said the same thing when Bear Stearns went down in 2008. Everything was going to be alright,” said Prof Seru.

First Republic lends to technology start-ups, but it chiefly came unstuck on commercial real estate. It will not be the last on that score. Office blocks and industrial property are in the early stage of a deep slump. “Where we stand today is a nearly perfect storm,” said Jeff Fine, real estate guru at Goldman Sachs.

“Rates have gone up 400 to 500 basis points in a year, and financing markets have almost completely shut down. We estimate there’s four to five trillion dollars of debt in the commercial (property) sectors, of which about a trillion is maturing in the next 12 to 18 months,” he said.

Packages of commercial property loans (CMBS) are typically on short maturities and have to be refinanced every two to three years. Borrowing exploded during the pandemic when the Fed flooded the system with liquidity. That debt comes due in late 2023 and 2024.

Could the losses be as bad as the subprime crisis? Probably not. Capital Economics says the investment bubble in US residential property peaked at 6.5pc of GDP in 2007. The comparable figure for commercial property today is 2.6pc.

But the threat is not trivial either. US commercial property prices have so far fallen by just 4pc to 5pc. Capital Economics expects a peak to trough decline of 22pc. This will wreak further havoc on the loan portfolios of the regional banks that account for 70pc of all commercial property financing.

“In a worst case scenario, it could create a ‘doom loop’ which accelerates a real estate downturn that then feeds back into the banking system,” said Neil Shearing, the group’s chief economist.

Silicon Valley Bank’s travails were different. Its sin was to park excess deposits in what is supposed to be the safest financial asset in the world: US treasuries. It was encouraged to do so under the risk-weighting rules of the Basel regulators.

Some of these debt securities have lost 20pc on long maturities – a theoretical paper loss only until you have to sell them to cover deposit flight.

The US authorities say the bank should have hedged this Treasury debt with interest rate derivatives. But as the Hoover paper makes clear, hedging merely transfers losses from one bank to another bank. The counterparty that underwrites the hedge contract takes the hit instead.

The root cause of this bond and banking crisis lies in the erratic behaviour and perverse incentives created by the Fed and the US Treasury over many years, culminating in the violent lurch from ultra-easy money to ultra-tight money now underway. They first created “interest rate risk” on a galactic scale: now they are detonating the delayed timebomb of their own creation.

Chris Whalen from Institutional Risk Analyst said we should be wary of a false narrative that pins all blame on miscreant banks. “The Fed’s excessive open market intervention from 2019 through 2022 was the primary cause of the failure of First Republic as well as Silicon Valley Bank,” he said.

Mr Whalen said US banks and bond investors (i.e. pension funds and insurance companies) are “holding the bag” on $5 trillion of implicit losses left by the final blow-off phase of the Fed’s QE experiment. “Since US banks only have about $2 trillion in tangible equity capital, we have a problem,” he said.

He predicts that the banking crisis will keep moving up the food chain from the original outliers to mainstream banks until the Fed backs off and slashes rates by 100 basis points.

The Fed has no intention of backing off. It plans to raise rates further. It continues to shrink the US money supply at a record pace with $95bn of quantitative tightening each month.

The horrible truth is that the world’s superpower central bank has made such a mess of affairs that it has to pick between two poisons: either it capitulates on inflation; or it lets a banking crisis reach systemic proportions. It has chosen a banking crisis.

This article is an extract from The Telegraph’s Economic Intelligence newsletter. Sign up here to get exclusive insight from two of the UK’s leading economic commentators – Ambrose Evans-Pritchard and Jeremy Warner – delivered direct to your inbox every Tuesday. |

Edited by - hallo84 on 05/03/2023 15:35:16 |

|

|

|

damau

路人甲乙丙

1855 Posts |

Posted - 05/03/2023 : 16:14:33 Posted - 05/03/2023 : 16:14:33

|

quote:

Originally posted by oneeast00

quote:

Originally posted by MCSEG

有點意思的東西,烏方秀出一張圖片

https://twitter.com/Osinttechnical/status/1652875263309406209

美製五英吋(127) Zuni火箭和Su-25攻擊機,應該是今

美規火箭不算屁

但.....Zuni就是珍獸 ..倒不是多猛,而是賣博物館更值錢...

美軍雖然還在用空射火箭,

但美軍現在統一使用 HYDRA 70mm/2.75吋規格 火箭(就是國軍直升機丟的)

5吋火箭 Zuni其實是越戰時期 F4,F5的彈藥,

當然A-10,F-16也能丟,但是已經20+年沒在USAF上鏡

連訓練掛載都沒上鏡了

據說美軍庫存的Zuni只剩幾千發

From wiki

In January 2023, the United States announced that it would be supplying 4,000 Zuni rockets to the Armed Forces of Ukraine for use in the Russo-Ukrainian War.

老美還是有雷射導引Zuni,不知這批援助的是不是雷射導引的那批. |

|

|

|

oneeast00

路人甲乙丙

3769 Posts |

Posted - 05/03/2023 : 17:00:00 Posted - 05/03/2023 : 17:00:00

|

quote:

Originally posted by MCSEG

有點意思的東西,烏方秀出一張圖片

https://twitter.com/Osinttechnical/status/1652875263309406209

美製五英吋(127) Zuni火箭和Su-25攻擊機,應該是今年初才拿到並整合

未來會不會也上APKWS套件呢?

另一方面,個人其實很不鳥APKWS...

因為按教範

HYDRA-70 主要目標就只是卡車/拖曳砲 軟目標

就算是Zuni , 也只能打IFV (BMP),SPH (Akatsiya)

講難聽點,

APKWS當初興起主要是給CIA 小弱雞的UAV(當年MQ-1),

來在大街上"文明地"處理一輛SUV/轎車,又能少傷百姓...

但俄烏已經是殺紅眼的大決戰,

更別說上圖Su-25,

要知道,Su-25標準武裝可是8顆500kg炸彈 相當於8000 Ib !!

根本不用遷就 APKWS這樣的CIA小牙籤...

如果老美決心讓U軍戰機有精確打擊移動目標能力

個人強力推薦老戰友: Paveway

1. Paveway從越戰開始生產至今海量

而且沒有火箭段,成本完全可以和APKWS拼

如果是二手庫存,價格交貨期更好談

2. Paveway改裝可以更簡單粗暴...

不必扯航電兼容,

因為就連沒什麼屁電腦的老F5都能掛能丟

雙座機後座加裝個"觀鳥鏡"就能自己瞄準

3.比起軟趴趴撐死只能打BMP的 APKWS

Paveway一發砸下去,連T14/T90都必成零件

就連大橋/大廈,被一發Paveway砸到也要嚇尿..

而且以GBU-12 (300kg)而論,

上面的Su-25也至少可以輕鬆帶8顆....

. |

Edited by - oneeast00 on 05/03/2023 17:39:48 |

|

|

|

cwchang2100

我是老鳥

Cayman Islands

17243 Posts |

Posted - 05/03/2023 : 18:13:49 Posted - 05/03/2023 : 18:13:49

|

quote:

Originally posted by hallo84

剩下的也差不多了

https://finance.yahoo.com/news/half-america-banks-already-insolvent-133000968.html

Half of America’s banks are potentially insolvent – this is how a credit crunch begins

Ambrose Evans-Pritchard

Tue, May 2, 2023 at 9:30 PM GMT+8

The twin crashes in US commercial real estate and the US bond market have collided with $9 trillion uninsured deposits in the American banking system. Such deposits can vanish in an afternoon in the cyber age.

The second and third biggest bank failures in US history have followed in quick succession. The US Treasury and Federal Reserve would like us to believe that they are “idiosyncratic”. That is a dangerous evasion.

Almost half of America’s 4,800 banks are already burning through their capital buffers. They may not have to mark all losses to market under US accounting rules but that does not make them solvent. Somebody will take those losses.

“It’s spooky. Thousands of banks are underwater,” said Professor Amit Seru, a banking expert at Stanford University. “Let’s not pretend that this is just about Silicon Valley Bank and First Republic. A lot of the US banking system is potentially insolvent.”

The full shock of monetary tightening by the Fed has yet to hit. A great edifice of debt faces a refinancing cliff-edge over the next six quarters. Only then will we learn whether the US financial system can safely deflate the excess leverage induced by extreme monetary stimulus during the pandemic.

A Hoover Institution report by Prof Seru and a group of banking experts calculates that more than 2,315 US banks are currently sitting on assets worth less than their liabilities. The market value of their loan portfolios is $2 trillion lower than the stated book value.

These lenders include big beasts. One of the 10 most vulnerable banks is a globally systemic entity with assets of over $1 trillion. Three others are large banks. “It is not just a problem for banks under $250bn that didn’t have to pass stress tests,” he said.

The US Treasury and the Federal Deposit Insurance Corporation (FDIC) thought they had stemmed the crisis by bailing out uninsured depositors of Silicon Valley Bank and Signature Bank with a “systemic risk exemption” after these lenders collapsed in March.

The White House baulked at a blanket guarantee for all deposits because that would look like social welfare for the rich. Besides, the FDIC has only $127bn of assets (and less very soon) and may ultimately require its own bailout.

The authorities preferred to leave the matter vague, hoping that depositors would discern an implicit guarantee. The gamble failed. Depositors fled First Republic Bank at a fast and furious pace last week despite an earlier infusion of $30bn from a group of big banks.

White knights probing a possible takeover of First Republic recoiled once they examined the books and discovered the scale of real estate damage. The FDIC had to seize the bank, wiping out both shareholders and bondholders. It took a $13bn subsidy along with $50bn of loans to entice JP Morgan to pick up the pieces.

“No buyer would take First Republic without a public subsidy,” said Krishna Guha from Evercore ISI. He warns that hundreds of small and mid-sized banks will batten down the hatches and curb lending to avoid the same fate. This is how a credit crunch begins.

The share price of PacWest, the next on the sick list, fell 11pc in late trading on Monday. That will be the bellwether of what happens next.

The US authorities can contain the immediate liquidity crisis by guaranteeing all deposits temporarily. But that does not address the greater solvency crisis.

The Treasury and the FDIC are still in the denial phase. They blame the failures on reckless lending, bad management, and over-reliance on foot-loose uninsured depositors by a handful of banks. This has a familiar ring. “They said the same thing when Bear Stearns went down in 2008. Everything was going to be alright,” said Prof Seru.

First Republic lends to technology start-ups, but it chiefly came unstuck on commercial real estate. It will not be the last on that score. Office blocks and industrial property are in the early stage of a deep slump. “Where we stand today is a nearly perfect storm,” said Jeff Fine, real estate guru at Goldman Sachs.

“Rates have gone up 400 to 500 basis points in a year, and financing markets have almost completely shut down. We estimate there’s four to five trillion dollars of debt in the commercial (property) sectors, of which about a trillion is maturing in the next 12 to 18 months,” he said.

Packages of commercial property loans (CMBS) are typically on short maturities and have to be refinanced every two to three years. Borrowing exploded during the pandemic when the Fed flooded the system with liquidity. That debt comes due in late 2023 and 2024.

Could the losses be as bad as the subprime crisis? Probably not. Capital Economics says the investment bubble in US residential property peaked at 6.5pc of GDP in 2007. The comparable figure for commercial property today is 2.6pc.

But the threat is not trivial either. US commercial property prices have so far fallen by just 4pc to 5pc. Capital Economics expects a peak to trough decline of 22pc. This will wreak further havoc on the loan portfolios of the regional banks that account for 70pc of all commercial property financing.

“In a worst case scenario, it could create a ‘doom loop’ which accelerates a real estate downturn that then feeds back into the banking system,” said Neil Shearing, the group’s chief economist.

Silicon Valley Bank’s travails were different. Its sin was to park excess deposits in what is supposed to be the safest financial asset in the world: US treasuries. It was encouraged to do so under the risk-weighting rules of the Basel regulators.

Some of these debt securities have lost 20pc on long maturities – a theoretical paper loss only until you have to sell them to cover deposit flight.

The US authorities say the bank should have hedged this Treasury debt with interest rate derivatives. But as the Hoover paper makes clear, hedging merely transfers losses from one bank to another bank. The counterparty that underwrites the hedge contract takes the hit instead.

The root cause of this bond and banking crisis lies in the erratic behaviour and perverse incentives created by the Fed and the US Treasury over many years, culminating in the violent lurch from ultra-easy money to ultra-tight money now underway. They first created “interest rate risk” on a galactic scale: now they are detonating the delayed timebomb of their own creation.

Chris Whalen from Institutional Risk Analyst said we should be wary of a false narrative that pins all blame on miscreant banks. “The Fed’s excessive open market intervention from 2019 through 2022 was the primary cause of the failure of First Republic as well as Silicon Valley Bank,” he said.

Mr Whalen said US banks and bond investors (i.e. pension funds and insurance companies) are “holding the bag” on $5 trillion of implicit losses left by the final blow-off phase of the Fed’s QE experiment. “Since US banks only have about $2 trillion in tangible equity capital, we have a problem,” he said.

He predicts that the banking crisis will keep moving up the food chain from the original outliers to mainstream banks until the Fed backs off and slashes rates by 100 basis points.

The Fed has no intention of backing off. It plans to raise rates further. It continues to shrink the US money supply at a record pace with $95bn of quantitative tightening each month.

The horrible truth is that the world’s superpower central bank has made such a mess of affairs that it has to pick between two poisons: either it capitulates on inflation; or it lets a banking crisis reach systemic proportions. It has chosen a banking crisis.

This article is an extract from The Telegraph’s Economic Intelligence newsletter. Sign up here to get exclusive insight from two of the UK’s leading economic commentators – Ambrose Evans-Pritchard and Jeremy Warner – delivered direct to your inbox every Tuesday.

其實這些都是屁話,都假設最糟的情況.

如果你這麼有把握,那麼恭喜你! 發大財的機會到了!

2008年的"The Big Short"就要重演了!

你可以大量買進空單! 等到事情發生之後,你就大發財囉!

美國的資本市場就這麼有趣,永遠都有賺大錢的機會.

十幾年內就有兩次賺大錢的機會,可要好好把握!

個人是沒有這麼大的信心,估計下空單的,可能會發生慘劇. 呵呵

--------------------------------

這些秘密話語來自活著的耶穌,由迪迪摩斯•猶大•多馬記錄。

他說:「任何人發現了這些話的意義,將不會嚐到死亡的滋味。」

多馬福音第1節 |

Edited by - cwchang2100 on 05/03/2023 18:15:25 |

|

|

|

chaoren

路人甲乙丙

1262 Posts |

Posted - 05/03/2023 : 20:59:35 Posted - 05/03/2023 : 20:59:35

|

在拨款限额内 不经国会讨论 直接由行政单位自由批准武器援助 五月份到期 说实话这个信源我也正在查证 可是狗日的法案4000多页

Fiscal Year 2023 National Defense Authorization Act

Fiscal Year 2023 Omnibus Appropriations Bill quote:

Originally posted by BlueWhaleMoon

quote:

Originally posted by chaoren

1 450亿援助法案5月份到期了吧 不能自由援助军火了 共和党可是放话要逐条审查的

2022/12/25

美國國會眾議院廿三日趕在午夜期限前夕,通過規模達一.七兆美元(約三○.七六兆台幣)的年度開支法案,其中包括提供破紀錄的軍事經費以及約四五○億美元的烏克蘭緊急援助經費;由於參議院稍早已通過類似法案,該法案將送交拜登總統簽署生效。

===

美國的聯邦政府財政年是10月1日起計,請問一下5月份到期是甚麼意思?

==

唯一支持蔡總統國防預算占GDP3%政策

|

|

|

|

冗丙

版主

Taiwan

16304 Posts |

|

|

白河子

路人甲乙丙

Taiwan

4559 Posts |

Posted - 05/03/2023 : 22:39:28 Posted - 05/03/2023 : 22:39:28

|

| 那個炸得有夠假,只有空爆連直擊都沒有... |

|

|

|

MCSEG

路人甲乙丙

Taiwan

2546 Posts |

|

|

Lugiahua

路人甲乙丙

USA

1884 Posts |

Posted - 05/04/2023 : 02:43:18 Posted - 05/04/2023 : 02:43:18

|

quote:

Originally posted by oneeast00

Hydra70有HEAT/Frag雙用彈頭

那個要炸穿戰車車頂不是問題, 甚至沒裝ERA側面也有可能貫穿

至於Zuni就更不用說了

那個用最傳統HE彈頭都跟155榴彈裝藥相同

近炸都足以癱瘓戰車, 更不用說有HEAT彈頭選項 |

|

|

|

慎.中野

我是老鳥

28702 Posts |

Posted - 05/04/2023 : 07:26:59 Posted - 05/04/2023 : 07:26:59

|

https://www.cna.com.tw/news/aopl/202305030410.aspx

烏克蘭否認派無人機行刺蒲亭 稱不會攻擊克里姆林宮[影]

2023/5/3 21:54(5/3 22:16 更新)

(中央社莫斯科3日綜合外電報導)俄羅斯社群媒體上今天廣傳克里姆林宮上方爆出火光後冒出白煙的畫面,克里姆林宮指控烏克蘭暗夜派無人機試圖行刺總統蒲亭未遂。烏克蘭斷然否認,強調與俄方所控事件無關。

法新社引述烏克蘭總統澤倫斯基(Volodymyr Zelenskyy)的顧問波多利雅科(Mykhailo Podolyak)說:「無人機攻擊克里姆林宮一事與烏克蘭毫無關聯。烏克蘭不會攻擊克里姆林宮,因為,首先,那解決不了任何軍事目標。」

...

----

----

「我乃是根據個人一向仰賴的研究方法而得出結論。我的方法就是:道聽途說加上斷章取義,然後歸納推理,最後忘掉訊息來源,開始強詞奪理,堅持我所言就是既定事實。」

史考特.亞當斯,《呆伯特之黃鼠狼當道》 |

|

|

|

cwchang2100

我是老鳥

Cayman Islands

17243 Posts |

Posted - 05/04/2023 : 14:08:13 Posted - 05/04/2023 : 14:08:13

|

現在烏克蘭的戰況居然有點令人驚喜的進展?!

烏軍居然在巴赫穆特反推了一點?! 這是怎麼回事?!

果然,人不要亂立Flag,剛有黃俄孝子說U軍在巴赫穆特撐不過一星期.

這下,R軍居然被U軍反推了?! 這下子估計從前幾天講的一星期,恐怕很快又要過去了.

這個打臉的速度之快,也不能怪別人,畢竟是自己要立快速被打臉的Flag! 難道要怪U軍囉?!

R軍也未免太不爭氣了,這下子克里姆林宮又被無人機炸了.

以前打到莫斯科的時候,說是天氣不好,風雨大,所以莫斯科沈了.

現在看來風雨大已經無法解釋無人機打到莫斯科的事,因為影片看來無風無雨.

目前烏南地區,也開始小打小鬧起來了.等到武器彈藥都到位之後,有一波攻勢的機率不低.

只是不知道會從哪裡開始進行?! 何時開始?!

--------------------------------

這些秘密話語來自活著的耶穌,由迪迪摩斯•猶大•多馬記錄。

他說:「任何人發現了這些話的意義,將不會嚐到死亡的滋味。」

多馬福音第1節 |

|

|

|

BlueWhaleMoon

我是老鳥

13639 Posts |

Posted - 05/04/2023 : 14:14:35 Posted - 05/04/2023 : 14:14:35

|

2023/2/27

瑟爾斯基目前主導捍衛巴赫姆特的戰事,已經數度前往當地視察,強調烏軍一定會守住。

===

不知道現在戰況如何,不過瑟爾斯基已經守了超過兩個月了。

==

唯一支持蔡總統國防預算占GDP3%政策 |

|

|

|

waffe

我是老鳥

7590 Posts |

Posted - 05/04/2023 : 16:13:06 Posted - 05/04/2023 : 16:13:06

|

quote:

Originally posted by 白河子

那個炸得有夠假,只有空爆連直擊都沒有...

空爆?飛過去都算很大條的事,莫說毛子的地標克宮,哪天凱道府被一下敵方無人機滑過你看事會有多大條。 |

|

|

|

ki1

我是老鳥

6644 Posts |

Posted - 05/04/2023 : 20:28:42 Posted - 05/04/2023 : 20:28:42

|

quote:

Originally posted by oneeast00

但俄烏已經是殺紅眼的大決戰,

更別說上圖Su-25,

要知道,Su-25標準武裝可是8顆500kg炸彈 相當於8000 Ib !!

根本不用遷就 APKWS這樣的CIA小牙籤...

以烏俄雙方Su-25實際出擊情形,武裝往往遠遠不及"8顆500kg炸彈"(4噸)

烏軍可能有簡易機場砲道長度不足的顧慮,但俄軍應該無此顧慮

對極低空飛行和拋射火箭時機動性的影響或許是重要因素

次要因素或許是清空火箭的時間,太多的話若無導引,發射時間拉長後散佈可能已經大得不切實際,飛機也可能衝得太高

(Mi-8亦往往只攜帶一對莢艙,而讓剩餘掛點空著)

例:

烏軍Su-25僅攜帶兩個(左右翼下各一)5聯裝S-13(122mm,和美式127mm火箭類似)火箭莢艙

https://www.reddit.com/r/CombatFootage/comments/137eo4f/cockpit_footage_of_a_ukrainian_su25_attacking/

俄軍Su-25亦以同樣裝備出擊,只是使用的掛點不同(較為靠外)

https://www.reddit.com/r/CombatFootage/comments/x3h5r4/russian_su25_rooks_firing_rockets_towards/

https://en.wikipedia.org/wiki/S-13_rocket

即使以最重的火箭/莢艙計算,也僅略多於一噸

俄軍Su-25以4枚S-24火箭出擊,酬載重量略少於一噸(235kg*4)

https://www.facebook.com/watch/?v=320943003571354

https://en.wikipedia.org/wiki/S-24_rocket

烏軍Su-25以4枚S-25火箭出擊,即使考慮發射管重量,也大約不到兩噸

https://en.wikipedia.org/wiki/S-25_(rocket) |

|

|

|

MCSEG

路人甲乙丙

Taiwan

2546 Posts |

|

|

MCSEG

路人甲乙丙

Taiwan

2546 Posts |

|

|

cwchang2100

我是老鳥

Cayman Islands

17243 Posts |

Posted - 05/05/2023 : 23:42:36 Posted - 05/05/2023 : 23:42:36

|

quote:

Originally posted by MCSEG

俄羅斯於5月4日凌晨對基輔發動的飛彈空襲

首次證實Kh-47M2 Kinzhal匕首超音速飛彈被擊落

應該是PAC-3愛國者防空系統建功

<恕刪>

https://defence-ua.com/weapon_and_tech/giperzvukovij_h_47_kinzhal_uspishno_zbito_zsu_foto_ulamkiv_j_pojasnennja_prichini_silnogo_vibuhu_unochi_4_travnja_nad_kijevom-11498.html

如果Kh-47M2真的被PAC-3打下來,這就真的是個里程碑的事件了!!!

因為Kh-47M2的極速高達10-13馬赫,在以往的小粉紅眼中,這根本是無從攔截的神器.

但是,在現實世界,這麼高速的導彈,居然被研發已久的愛國者三幹掉.簡直是慘劇發生.

像是東風16中短程彈道導彈,終端速度也不過只有8馬赫.而且還是容易預測的傳統彈道.

那麼豈不是輕易就會被愛國者3攔截?! 從此中短程彈道導彈的無敵神話,不就完全破滅了.

目前美帝還在研發更加先進的Glide Phase Interceptor (GPI),連高超音速的滑翔體都要攔截.

這簡直是不給人活路了! 如果各類導彈都能被輕鬆攔截,未來東風洗地的神話不就GG了?!

以後號稱"沖繩快遞"的武器,可能要改稱"沖繩快靶"了.

俄烏戰爭真是一面殘忍的照妖鏡,誰沒穿褲子,潮水退去後,一清二楚.

俄系武器在這一年多的戰爭中,嚴重落漆,連帶西台灣的厲害武器,也被人看穿手腳.

--------------------------------

這些秘密話語來自活著的耶穌,由迪迪摩斯•猶大•多馬記錄。

他說:「任何人發現了這些話的意義,將不會嚐到死亡的滋味。」

多馬福音第1節 |

|

|

|

gera

我是老鳥

7156 Posts |

Posted - 05/06/2023 : 00:17:43 Posted - 05/06/2023 : 00:17:43

|

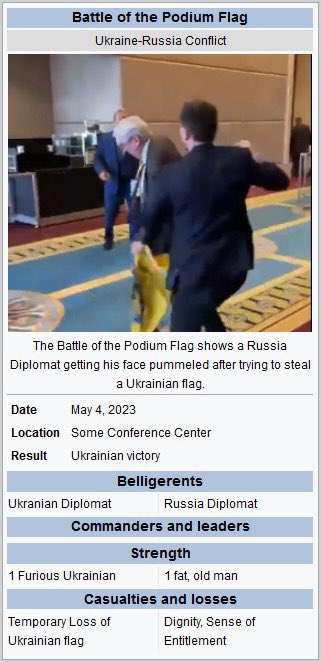

這件事的意義就是,俄羅斯人還活在大國榮耀的時代,他們看不起烏克蘭人,

所以才會上去動手搶旗,

但烏克蘭人還手了,還揍他,

這也是為什麼烏克蘭戰爭真正會爆發的原因,

克里姆林宮,甚至於俄羅斯人,都沒想過烏克蘭人居然敢還手,敢抵抗,

只是烏克蘭人還手了,還往死裡揍.

最恐怖的是,戰爭已經打了15個月,俄羅斯人還是無法面對現實,

因此俄羅斯無法體面的結束戰爭,

這也不是克里姆林宮與普丁做不到,而是真照烏克蘭的條件,承認失敗,

那麼俄羅斯會迎來第二次崩解,就是各個少數民族與共和國都會試著脫離莫斯科,

看出這點而磨刀霍霍的國家可不少...

2023年的5~8月夏季攻勢,以目前來說,還評估不出烏克蘭能有何進展,

烏軍能不能局部擊敗俄軍,能,

但能突破多深,這看不出來,俄軍設了很多道防線,在後方還有預備防線,因此烏軍很難恢復機動性打成機動戰,

俄軍現在是求銷耗烏軍到迫使烏軍講和.

但到了9月以後,俄軍想再重覆22年的冬季攻勢則越來越難,補給,裝備,人力都太於缺乏,

這時候有可能變盤,

克里姆林宮可能會設法去捏更軟的柿子,白俄羅斯可能是數一數二,

盧卡申科與白俄軍有一定可能不會與不敢還手,俄羅斯再一次併回白俄羅斯可以很好的提振克里姆林宮的聲望,

如此克里姆林宮又一定可能也擺脫烏克蘭戰爭,克里姆林宮的底線大概是保留克里米亞,其他都可以還給烏克蘭,

這樣莫斯科的統治就可能維持下去.

如果白俄軍抗命還手,那又是另一回事了.只是先前俄羅斯已經軟化過白俄,抽走他們的武器裝備與軍火,

盧卡申科還不敢拒絕.

|

|

|

|

cwchang2100

我是老鳥

Cayman Islands

17243 Posts |

Posted - 05/06/2023 : 02:32:28 Posted - 05/06/2023 : 02:32:28

|

其實,這是土耳其主辦的黑海經濟合作組織(BSEC)所舉辦的議員大會(PABSEC).

因為俄羅斯和烏克蘭都是會員國,湊在一起開會,怎麼會沒有衝突呢??

土耳其人也太過天真,居然找了兩方議員都來開會.

一開始,俄羅斯的金髮美女代表演說的時候,烏克蘭議員就展開國旗抗議,還靠在俄羅斯美女代表旁.

搞得場面很尷尬,雙方就吵了起來.土耳其主席看場面失控,就要把烏克蘭代表趕出場.

這是第一個事件.主要是土耳其的安排不恰當,這樣搞,當然會起衝突了.

接下來,第二件事情就是俄羅斯的代表估計覺得很沒面子,怎麼可以讓金髮美女代表吃鱉.

所以,會後跑去搶了烏克蘭代表的國旗.但是可惜俄羅斯方面的代表也是年老體衰,

沒預料到烏克蘭代表年輕體強,立馬跑過來搶回國旗,還胖揍了俄羅斯代表臉上一拳,國旗也被搶回去了.

其實烏克蘭代表,還想多揍幾拳,礙於會議的警衛攔阻,俄羅斯代表倖免於難.

會後據說被送到醫院檢查治療.

看來俄羅斯方都是一群老弱婦孺,還敢去搶烏克蘭國旗,真是不知量力.難怪被人痛揍一拳.

俄羅斯的外交部門,自然要大做文章,宣稱烏克蘭做出不適當的暴力行為.

其實,兩個是敵對國家,碰到一起必定會有衝突,這是天經地義的事.

不過,俄羅斯終究是打輸了,畢竟顏面無光.目前外電多數關注後面的被打事件,俄羅斯在宣傳戰上,算是有些失利了.

https://www.politico.eu/article/ukraine-russia-slap-valery-stavitsky-oleksandr-marikovski-black-sea-nations-assembly-pabsec/

Ukraine official slaps Russian delegate at Black Sea nations assembly

https://twitter.com/nexta_tv/status/1654196101052788736

A scandal at the PABSEC summit in #Turkey - the Parliamentary Assembly of the Black Sea Economic Cooperation.

https://en.wikipedia.org/wiki/Organization_of_the_Black_Sea_Economic_Cooperation

Organization of the Black Sea Economic Cooperation

--------------------------------

這些秘密話語來自活著的耶穌,由迪迪摩斯•猶大•多馬記錄。

他說:「任何人發現了這些話的意義,將不會嚐到死亡的滋味。」

多馬福音第1節 |

|

|

|

MCSEG

路人甲乙丙

Taiwan

2546 Posts |

Posted - 05/06/2023 : 12:17:29 Posted - 05/06/2023 : 12:17:29

|

quote:

Originally posted by cwchang2100

如果Kh-47M2真的被PAC-3打下來,這就真的是個里程碑的事件了!!!

因為Kh-47M2的極速高達10-13馬赫,在以往的小粉紅眼中,這根本是無從攔截的神器.

但是,在現實世界,這麼高速的導彈,居然被研發已久的愛國者三幹掉.簡直是慘劇發生.

像是東風16中短程彈道導彈,終端速度也不過只有8馬赫.而且還是容易預測的傳統彈道.

那麼豈不是輕易就會被愛國者3攔截?! 從此中短程彈道導彈的無敵神話,不就完全破滅了.

目前美帝還在研發更加先進的Glide Phase Interceptor (GPI),連高超音速的滑翔體都要攔截.

這簡直是不給人活路了! 如果各類導彈都能被輕鬆攔截,未來東風洗地的神話不就GG了?!

以後號稱"沖繩快遞"的武器,可能要改稱"沖繩快靶"了.

俄烏戰爭真是一面殘忍的照妖鏡,誰沒穿褲子,潮水退去後,一清二楚.

俄系武器在這一年多的戰爭中,嚴重落漆,連帶西台灣的厲害武器,也被人看穿手腳.

烏克蘭空軍官方很低調,不評論「愛國者擊落匕首」之說

https://www.facebook.com/kpszsu/posts/625562786278340

更新:烏克蘭空軍司令出面證實是真的了

https://defence-blog.com/ukraines-top-official-confirms-russian-hypersonic-missile-shot-down/

已知他們收到的愛國者約兩套(連),第一套是德國的PAC-2,第二套是美國的

從右上角那張圖片推測,伊斯坎達爾或匕首的鼻錐罩被某東西撞擊破損

只有硬殺式的愛國者最符合

反過來說,匕首就是10馬赫、2000公里、彈頭500公斤

最近幾年才開始服役的匕首超音速飛彈,外界推估價格破一千萬美金

同樣的價格可以買六發的戰斧(150萬左右)

=======================================

俄防長紹伊古視察南部軍區的武器儲存場,了解戰備狀況

有點違和的是,一排停放T-90M,另一排是T-62M,代差有點大

https://twitter.com/RedIntelPanda/status/1654519004340338691

=======================================

俄控區首長宣布,疏散札波羅熱地區的18處村鎮(定居點)

老弱婦孺向後撤,以防烏軍的炮擊和攻勢

https://tass.com/politics/1614185

https://ria.ru/20230506/rogov-1870096273.html?rcmd_alg=slotter

山雨欲來風滿樓啊~ |

Edited by - MCSEG on 05/06/2023 17:57:44 |

|

|

|

guy123

路人甲乙丙

3907 Posts |

|

|

hallo84

新手上路

55 Posts |

Posted - 05/06/2023 : 20:04:04 Posted - 05/06/2023 : 20:04:04

|

quote:

Originally posted by cwchang2100

其實這些都是屁話,都假設最糟的情況.

如果你這麼有把握,那麼恭喜你! 發大財的機會到了!

2008年的"The Big Short"就要重演了!

你可以大量買進空單! 等到事情發生之後,你就大發財囉!

美國的資本市場就這麼有趣,永遠都有賺大錢的機會.

十幾年內就有兩次賺大錢的機會,可要好好把握!

個人是沒有這麼大的信心,估計下空單的,可能會發生慘劇. 呵呵

--------------------------------

這些秘密話語來自活著的耶穌,由迪迪摩斯•猶大•多馬記錄。

他說:「任何人發現了這些話的意義,將不會嚐到死亡的滋味。」

多馬福音第1節

是不是屁話專家已經評論了。美國金融業這次差不多了

USA TODAY

US banking crisis: Close to 190 banks could collapse, according to study

Swapna Venugopal Ramaswamy, USA TODAY

Fri, May 5, 2023 at 6:56 AM GMT+8

With the failure of three regional banks since March, and another one teetering on the brink, will America soon see a cascade of bank failures?

Bloomberg reported Wednesday that San Francisco-based PacWest Bancorp is mulling a sale.

Last week, First Republic Bank became the third bank to collapse, the second-largest bank failure in U.S. history after Washington Mutual, which collapsed in 2008 amid the financial crisis.

After the demise of Silicon Valley Bank and Signature Bank in March, a study on the fragility of the U.S. banking system found that 186 more banks are at risk of failure even if only half of their uninsured depositors (uninsured depositors stand to lose a part of their deposits if the bank fails, potentially giving them incentives to run) decide to withdraw their funds.

Uninsured deposits are customer deposits greater than the $250,000 FDIC deposit insurance limit.

Why are regional banks failing?

Security guards let individuals enter the Silicon Valley Bank's headquarters in Santa Clara, Calif., March 13, 2023.

Security guards let individuals enter the Silicon Valley Bank's headquarters in Santa Clara, Calif., March 13, 2023.

Regional banks are failing because the Federal Reserve’s aggressive interest rate hikes to tamp down inflation have eroded the value of bank assets such as government bonds and mortgage-backed securities.

Most bonds pay a fixed interest rate that becomes attractive when interest rates fall, driving up demand and the price of the bond. On the other hand, if interest rates rise, investors will no longer prefer the lower fixed interest rate paid by a bond, thus driving down its price.

Many banks increased their holdings of bonds during the pandemic, when deposits were plentiful but loan demand and yields were weak. For many banks, these unrealized losses will stay on paper. But others may face actual losses if they have to sell securities for liquidity or other reasons, according to the Federal Reserve Bank of St. Louis.

“The recent declines in bank asset values very significantly increased the fragility of the U.S. banking system to uninsured depositor runs,” economists wrote in a recent paper published on the Social Science Research Network

Of course, this scenario would play out only if the government did nothing.

“So, our calculations suggest these banks are certainly at a potential risk of a run, absent other government intervention or recapitalization,” the economists wrote.

How did Silicon Valley Bank collapse?

In the case of the Santa Clara-based Silicon Valley Bank, which held most of its assets in U.S. government bonds, the market value of its bonds fell when interest rates started going up.

That’s because most bonds pay a fixed interest rate that becomes more attractive if interest rates fall, driving up demand and the price of the bond. But when interest rates rise, the lower fixed interest rate paid by a bond is no longer attractive to investors.

The timing coincided with the financial difficulties many of the banks’ customers – largely tech startups – were dealing with, forcing them to withdraw their deposits.

In addition, Silicon Valley Bank had a disproportional share of uninsured funding, with only 1% of banks having higher uninsured leverage, the paper notes. "Combined, losses and uninsured leverage provide incentives for an SVB uninsured depositor run."

A run on these banks could pose a risk to even insured depositors − those with $250,000 or less in the bank − as the FDIC’s deposit insurance fund starts incurring losses, the economists wrote.

Swapna Venugopal Ramaswamy is a housing and economy correspondent for USA TODAY. You can follow her on Twitter @SwapnaVenugopal and sign up for our Daily Money newsletter here.

This article originally appeared on USA TODAY: Three banks have collapsed,183 new banks could fail, says new study |

|

|

|

Reinherd Von Hwang提督

我是老鳥

USA

9691 Posts |

Posted - 05/06/2023 : 21:53:28 Posted - 05/06/2023 : 21:53:28

|

quote:

Originally posted by Lugiahua

quote:

Originally posted by oneeast00

Hydra70有HEAT/Frag雙用彈頭

那個要炸穿戰車車頂不是問題, 甚至沒裝ERA側面也有可能貫穿

1. 雷射導引的Hydra 70可以有限進行空對空戰鬥,尤其是對付廉價的UAV。

2. 如果是裝HEAT破甲榴彈,的確殺傷力不足,因為破甲榴彈需要產生金屬噴流。

導致彈頭的空間大多數是中空的,而非填滿炸藥。

但是如果改成HE高爆彈藥,那爆炸威力也還是很可觀。

另外Hydra 70的HEAT我記得沒錯的話跟M72 66火箭彈應該是同一枚。

M72應該是沒有辦法打穿當代俄國主力戰車的側面裝甲巴。

(例如T-90戰車)

我也不知道答案但是我這樣猜測。

|

|

|

|

MCSEG

路人甲乙丙

Taiwan

2546 Posts |

|

標題 標題  |

|

|

|